If you are looking for the current share price of Tesla, you have come to the right place. Tesla’s stock is one of the most talked-about in the global market, and many investors watch its price closely. This article dives deep into Tesla’s current share price, recent trends, factors influencing the stock, and what experts predict for the future. Whether you are a beginner investor or a seasoned trader, this detailed guide will give you clear insights into Tesla’s stock market performance in 2025.

Understanding the Current Share Price of Tesla

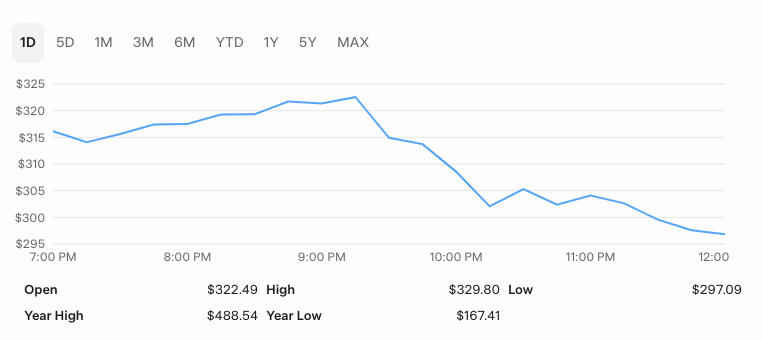

The current share price of Tesla reflects the market value of one share of Tesla Inc., a company famous for its electric vehicles and innovative energy solutions. Tesla’s shares are traded on the NASDAQ under the ticker symbol TSLA. The share price changes throughout the trading day, influenced by supply and demand, company performance, market sentiment, and macroeconomic factors.

Tesla’s stock has seen tremendous growth over the last decade, becoming one of the highest-valued automakers globally. Investors closely monitor the current share prices of Tesla as it can be volatile, often reacting to news, earnings reports, and Elon Musk’s public statements.

Tesla’s Share Price: Recent Trends and Movements in 2025

Tesla’s stock price in 2025 has experienced both highs and lows. In recent weeks, several events have impacted the stock:

- A public feud between Elon Musk and former President Donald Trump caused a sharp decline.

- Tesla shares dropped approximately 8% following Musk’s criticism of a US tax bill.

- Market analysts noted increased volatility due to geopolitical tensions and regulatory changes.

Table: Tesla Share Price Movements in 2025

| Month | Opening Price (USD) | Closing Price (USD) | % Change | Key Event |

|---|---|---|---|---|

| January | 720 | 740 | +2.7% | Strong Q4 earnings |

| March | 760 | 730 | -3.9% | Supply chain concerns |

| May | 780 | 720 | -7.7% | Musk-Trump public feud |

| June (current) | 715 | 700 (estimate) | -2.1% | Regulatory scrutiny |

What Factors Affect the Current Share Price of Tesla?

Several key factors influence Tesla’s stock price. Understanding these can help investors anticipate market movements and make informed decisions.

1. Company Performance and Earnings

Tesla’s quarterly earnings reports provide vital information on revenue, profit margins, vehicle deliveries, and growth strategies. Strong earnings usually boost investor confidence, pushing the share price up.

2. Market Sentiment and Public Perception

Elon Musk’s public statements, social media activity, and leadership style significantly impact Tesla’s stock. For example, the recent clash with Donald Trump negatively affected investor sentiment.

3. Industry Trends and Competition

The electric vehicle (EV) market is rapidly evolving. Competitors like Ford, GM, and newer entrants influence Tesla’s market share. Government policies promoting green energy also play a role.

4. Economic and Regulatory Environment

Global economic conditions, interest rates, and government regulations on emissions and subsidies influence Tesla’s stock. Recent regulatory scrutiny in the US and China has caused some volatility.

5. Technological Innovation

Tesla’s investments in battery technology, autonomous driving, and energy products are long-term growth drivers that positively influence stock price.

How to Track the Current Share Prices of Tesla

Tracking Tesla’s share price in real-time is easy using various platforms:

- Stock Market Apps: Apps like Robinhood, E*TRADE, and TD Ameritrade offer real-time stock prices.

- Financial News Websites: Websites like CNBC, Bloomberg, and MarketWatch provide live updates and expert analysis.

- NASDAQ Website: The official NASDAQ site shows TSLA stock information.

- Google Search: Typing “current share prices of Tesla” instantly displays the latest price.

Expert Analysis: Is Tesla Stock a Good Buy in 2025?

Market experts remain divided on Tesla’s future stock performance. Some bullish analysts believe:

- Tesla’s innovation and leadership in EV market will drive long-term gains.

- Expansion into energy storage and solar business offers new revenue streams.

- Growth in international markets like China and Europe will boost sales.

Conversely, cautious analysts highlight:

- Tesla’s high valuation compared to traditional automakers.

- Risks from increasing competition and regulatory pressures.

- Volatility due to Elon Musk’s controversial statements and business moves.

Key Metrics to Watch Beyond Share Price

Investors looking at Tesla should also consider:

- Price to Earnings (P/E) Ratio: Helps understand valuation relative to earnings.

- Earnings Per Share (EPS): Indicates company profitability.

- Debt Levels: Tesla’s balance sheet strength is important.

- Vehicle Delivery Numbers: A critical growth indicator.

- Cash Flow: Tesla’s ability to generate free cash affects sustainability.

FAQs about Current Share Prices of Tesla

What is the current share prices of Tesla?

Tesla’s share price fluctuates throughout the trading day. For the latest price, check trusted financial websites or stock apps.

Why does Tesla’s stock price change so much?

Tesla is considered a volatile stock due to high investor interest, Elon Musk’s influence, and rapid changes in the EV industry.

How can I invest in Tesla shares?

You can buy Tesla stock through brokerage accounts that provide access to NASDAQ stocks.

What affects Tesla’s stock price the most?

Earnings reports, market sentiment, regulatory news, and company announcements typically impact Tesla’s share price.

Is Tesla a good investment for the future?

It depends on your risk tolerance and investment goals. Tesla has strong growth potential but also faces risks.

Conclusion: Keeping an Eye on Tesla’s Share Price in 2025

The current share prices of Tesla is a reflection of the company’s dynamic role in transforming the automotive and energy sectors. While recent months have seen volatility due to external factors, Tesla remains a key player worth watching for investors. By understanding the factors driving its stock price and tracking updates regularly, investors can make smarter decisions.

Tesla’s future depends on its ability to innovate, navigate competition, and manage market expectations. Whether you are a long-term holder or short-term trader, staying informed on Tesla’s stock will be crucial as 2025 unfolds.